Histórico da Página

...

| Expandir | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Use this process to reconcile sales imported with bills saved in the system. Main browser displays all sales records this routine has imported and enabled.

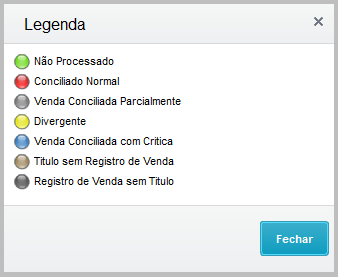

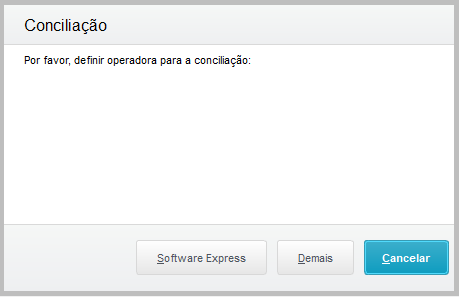

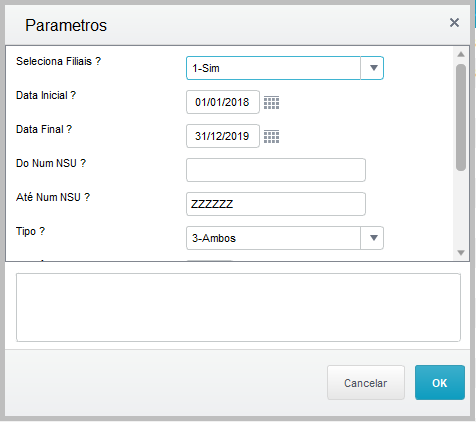

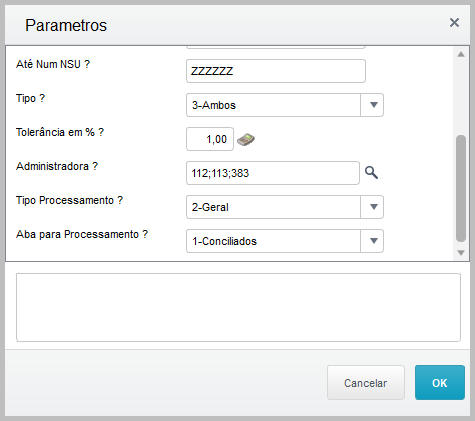

Captions:Captions are updated in accordance with user actions and the comparative results between Protheus and credit card company files. ReconcileWhen you select option reconcile, we have the following parameters screen At this point you need to choose between reconciling sales from the Software Express layout or from Others, which are comprised of Cielo, Rede and Amex: These options differ in the selection of Card Issuer x Card Company. For Software Express, you can select between one option of various card companies, whereas Others offers only the Cielo, Rede and Amex options. After selection, a screen is displayed with parameters you can select: Select Branch: You can select one or more branches. The field is multiple choice for reconciliation of multiple branches. Tolerance in %: Percentage of the difference in the bill balances between the net sale value of the imported file and the remaining bill balance in the system Card Company: Click the "magnifying glass" icon to display card companies. You may select one or more card companies to reconcile sales. (query yields data specific to your selection, whether Software Express or Others) Processing Type: Option created for you to choose the data processing type (by tab → display records of tab selected only) or (General → display records of all tabs) Tab for Processing: Tab to be used along with previous parameter. (1-Reconciled / 2-Partially Reconciled / 3-Bills Without Sales / 4-Sales Without Bills / 5-Divergent)

O processo de efetivação da conciliação apenas marca a venda como conciliada não demostrando mais esse venda em futuras conciliações. DesconciliarO processo retira as informação de conciliação do registro de venda, permitindo que a venda possa ser conciliada em processos futuros. Processo só pode ser executado caso a conciliação de pagamento não tenha sido executada. |

...

| Expandir | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

O Browse principal demonstra todos os registros de vendas/pagamentos importados e habilitados para essa rotina. É a partir desse browse que o processo de conciliação inicia. O processo permite a conciliação dos pagamentos, que são os registros provenientes das importações dos arquivos das operadoras: CIELO, REDECARD, AMEX e da Administradora SOFTWARE EXPRESS, com os registros financeiros do contas a receber, que teve como forma de pagamentos: cartão de crédito ou débito. Quando um pagamento for conciliado, o título sofrerá baixa e seu valor entrará no movimento bancário. Legenda:A atualização das legendas ocorre de acordo com as ações dos usuários, sendo o resultado da comparação entre o Protheus e os arquivos das operadoras: CIELO, REDECARD, AMEX e da Administradora SOFTWARE EXPRESS AlterarHavendo necessidades é possível alterar o campo "status" de um título de venda. Os status que podem ser alterados são: Baixado : Esse status ocorre quando os pagamentos foram conciliados, pois, nesse processo os títulos são baixados. Divergente: Esse status ocorre quando existirem devoluções total, devoluções parciais, charge back ou troca de modalidades. Não Processado: Esse status ocorre quando os titulo não foram conciliados. É importante ressaltar que os ajustes dos status não estornam a baixa dos títulos. ConciliaçãoAo selecionar a opção de conciliação temos a tela de parâmetros: Software Express ou Demais: Software Express: conciliação das vendas oriundas do Layout da Software Express. Demais: conciliação das vendas oriundas do Layout Demais sendo: Cielo, Rede e Amex. A diferença entre essas opções esta no fato de seleção da Operadora x Administradora. Para Software Express é possível selecionar diversas administradoras de cartões, enquanto que Demais só há opções de Cielo, Rede e Amex. Após a seleção será apresentada uma tela com os parâmetros a serem preenchidos:

|

04.

...

PARAMETERS

| Expandir | ||

|---|---|---|

| ||

Para correto funcionamento do conciliador os parâmetros abaixo devem ser configurados. MV_EMPTEF - Código do estabelecimento configurado para administradora Software Express MV_EMPTCIE - Código do estabelecimento configurado para operadora Cielo MV_EMPTAME - Código do estabelecimento configurado para operadora AMEX MV_EMPTRED - Código do estabelecimento configurado para operadora REDE Todos esses parâmetros devem ser exclusivos representando a Filial que será utilizada no conciliador. Demais parâmetros utilizados pela rotina: MV_USAMEP - Indica se o sistema deve usar a tabela MEP para realizar a conciliação dos arquivos SITEF (T = usa; F = não usa). MV_1DUP - Define inicialização da 1.parcela do titulo gerado Ex. A -> para sequencia alfa 1->para sequencia numérica. MV_LJGERTX - Gera contas a pagar para a administradora financeira com o valor da taxa, e não desconta esta taxa do contas a receber. MV_BXCNAB - Define se as baixas dos títulos no retorno do CNAB devem ser aglutinadas. (S)im ou (N)ão. MV_BLATHD - Quantidade de Threads para o processamento da Conciliação de pagamento. Máximo de 20. MV_BLADOC - Define se a conciliação será feita pelo campo NSU SITEF (FIF_NSUTEF) ou Número do Comprovante (FIF_NUCOMP) |

05.

...

ENTRY POINTS

| Expandir | ||

|---|---|---|

| ||

Pontos de entrada utilizados no processo de importação do arquivo de pagamento (Especifico Software Express) FINFIF - Permite a inclusão de campos no momento da importação do arquivo Software Express - Documento de apoio: http://tdn.totvs.com/x/SX4CE FIN910FIL - Permite alterar o conteudo do campo filial no momento da importação do arquivo Software Express - Documento de apoio: http://tdn.totvs.com/x/s4wDCw Pontos de entrada utilizados no processo de conciliação de pagamento. FINA910F - Define os dados bancários no momento da baixa dos títulos - Documento de apoio: http://tdn.totvs.com/x/X6Vc FA110TOT - Permite a gravação de dados complementares ao registro totalizador da baixa automática de títulos a receber (FINA110) - Documento de apoio: http://tdn.totvs.com/x/2YQDCw |

06.

...

TABLES

| Totvs custom tabs box | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Justification - EFT - FINA911

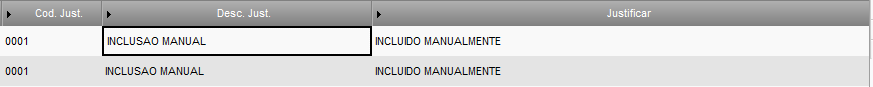

Enables the addition of standardized justifications to be used on the reconciliation screen.

Enter a code and a description.

The justification will be required when making effective the reconciliation processes of tabs: Partially Reconciled, Bill without Sale, Sales Without Bill and Divergent.

Adjustments Reasons - EFT - FINA912

Enables the addition of standardized reasons for utilization in divergences tab of reconciliation routines.

Enter company, a code and a description for this reason.

Reasons are documented in the manuals of each company.

Branches to Import - FINA913

It enables only some branches to use the reconciliation process. Use it directly in the file import process.

Enter the code of the branch enabled to import the files.

If you do not register any branch in this option, all branches will be enabled to import the file. When you use the register, the import process will only be completed successfully for the branches registered in it.

If you do not register a branch and find a record for it, the import log will inform that the branch is not enabled for import.

Import Wizard - FINA914

The file import process considers only layouts approved for Software Express, Cielo, Rede and Amex. This process ensures data integrity, storing criticisms for users to analyze and take measures.

Premises

- Card Issuer correctly registered in table "SITEF Administrators Code" with directory parameters duly set.

Eft.FileDir indicates the directory in which the file will be read.

Proc.FileDir indicates the directory to which the file will be moved after successful processing.

Proc.Inc.Dir indicates the directory to which the file will be moved after processing with error.

Note: to enable fields for input, Card Type must be RD - Rede

- Branch enabled for execution. See documentation about "Branch Registers to Consider" - FINA913.

- Import screen for payment/sales files from Card Companies.

- Detail on directories from which the files will be read.

The import does not consider the branch in which the process is taking place, given that files may have more than one establishment. Thus, branch control does not depend on the sharing of the table at issue.

- After importing it, a detailed log of criticisms per file is issued for the identification of problems.

Description of columns:

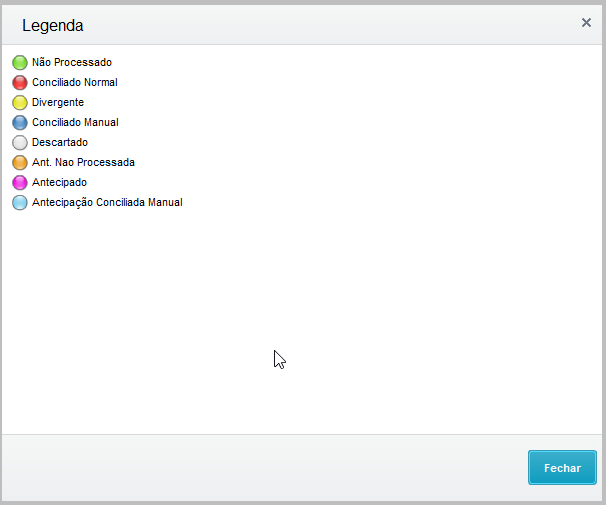

The Captions possible for this screen. The text of field Status follows caption details

File name: Provides details on the file imported. (the file name is used as a control method to avoid duplication of processing)

Processing Date: Date on which the operation was performed

Processing Time: Time in which the operation was performed

Rec. Added: Quantity of records added to sales/payments control table. (depending on the layout/card issuer, we may have sets of lines to form a sale/payment)

Not Processed: Quantity of lines not processed by problems/criticisms. (you may evaluate details on this processing through the import log - FINA917)

Lines Read: Quantity of lines read, sum of all lines evaluated by the program, considering even the header, trailer or any other line not processed by the routine.

Fi Li Tot: File lines total, the sum of lines not processed plus lines read.

User Code: Code of user who processed the import.

Co. Code: Code of Credit Card Company/Issuer involved in the operation. (this information is defined in accordance with the folder in which the file was made available)

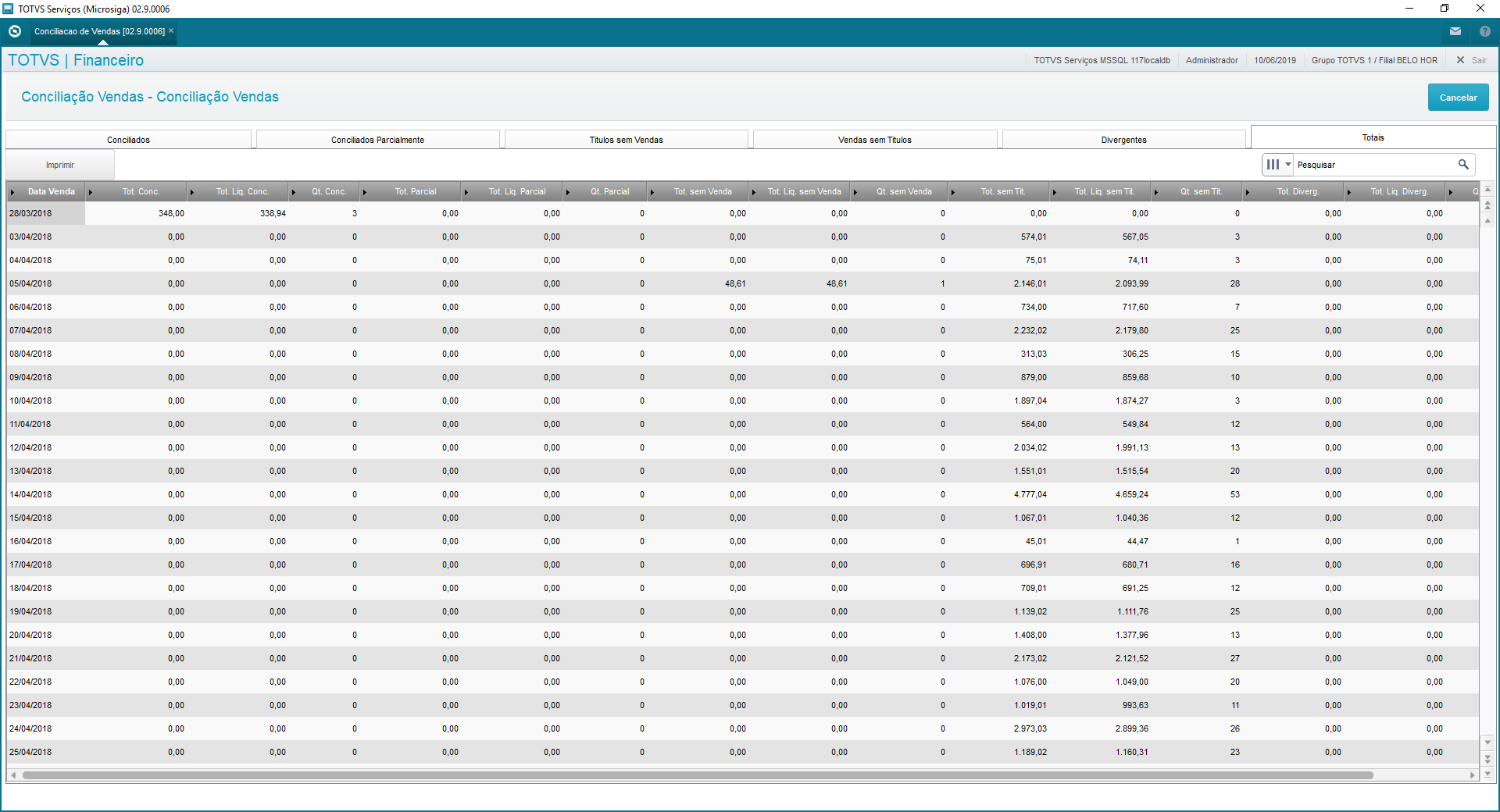

Sales Reconciliation - FINA916

Use this process to reconcile sales imported with bills saved in the system.

Main browser displays all sales records this routine has imported and enabled.

Caption:

Captions are updated in accordance with user actions and the comparative results between Protheus and credit card company files.When files are imported, all records start with "Not Processed", changing status as information is processed.Reconcile

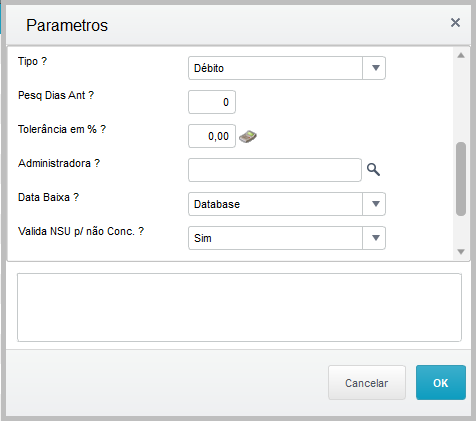

When you select option reconcile, we have the following parameters screen

At this point you need to choose between reconciling sales from the Software Express layout or from Others, which are comprised of Cielo, Rede and Amex:

These options differ in the selection of Card Issuer x Card Company. For Software Express, you can select between one option of various card companies, whereas Others offers only the Cielo, Rede and Amex options.

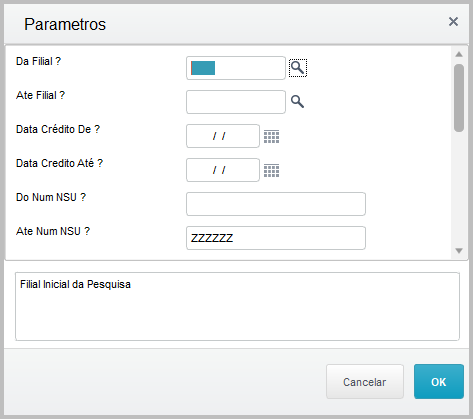

After selection, a screen is displayed with parameters you can select:

Select Branch: You can select one or more branches. The field is multiple choice for reconciliation of multiple branches. From Date: Start Date of sale reconciliation. (evaluate the issue date of sale) To Date: End Date of sale reconciliation. (evaluate issue date of sale) From NSU NO.?: NSU Number (Single Sequential Number) that starts the sale reconciliation. (with zeros to the left) To NSU No.?: NSU Number (Single Sequential Number) that ends the sale reconciliation. (with zeros to the left) Type: Select the type to be reconciled. Options: Debit/Credit or Both.

Tolerance in %: Percentage of the difference in the bill balances between the net sale value of the imported file and the remaining bill balance in the system

Card Company: Click the "magnifying glass" icon to display card companies. You may select one or more card companies to reconcile sales. (query yields data specific to your selection, whether Software Express or Others)

Processing Type: Option created for you to choose the data processing type (by tab → display records of tab selected only) or (General → display records of all tabs)

Tab for Processing: Tab to be used along with previous parameter. (1-Reconciled / 2-Partially Reconciled / 3-Bills Without Sales / 4-Sales Without Bills / 5-Divergent)

Correspond to imported sales the counterparts of which (financial bills in Protheus) were found in accordance with the relationship key, Branch, Establishment, NSU, installment, issue date, authorization code, type (Debit/Credit) and tolerance percentage (the tolerance percentage is set in routine parameters).

Tolerance Percentage: Consider that the net sale value must be greater than or equal to the bill balance minus the specified percentage.

Example: Sale

...

Sale (file)

...

Bill (Protheus)

...

Gross Value BRL 200.00

...

Value BRL 195.00

...

Net Value BRL 198.00

...

Balance BRL 195.00

...

Tolerance percentage 10%

Use the following calculation to define whether to fully reconcile it.

Net Value >= Balance - ( Balance * Percentage)

198 >= 195 - (195 * 10%)

198 >= 195 - 19.5

198 >= 175.5

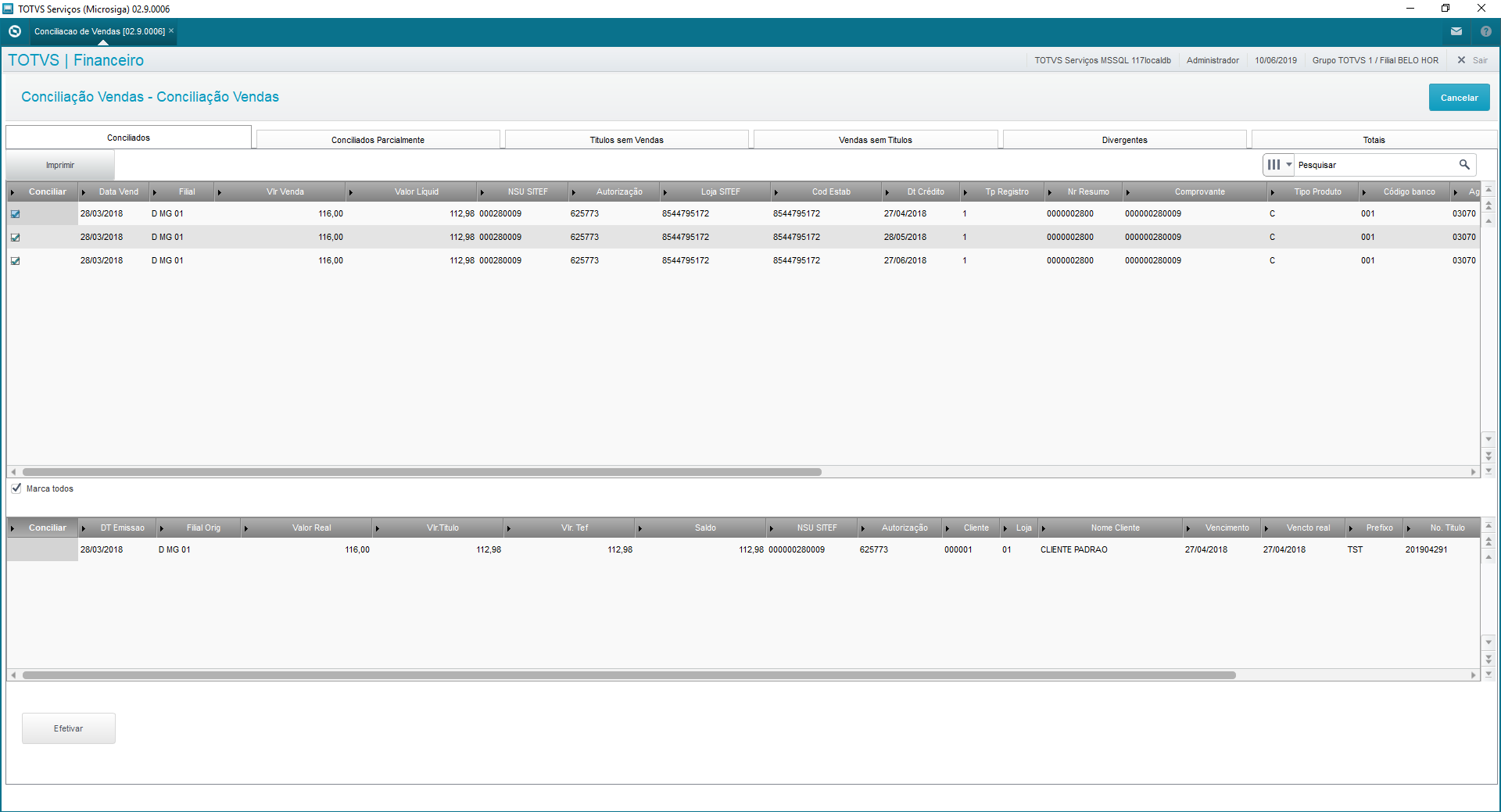

The upper grid shows sales imported through the issuer file, the lower grid shows data from the bill found in the system. The records already appear selected to make the reconciliation effective. You can select item by item or use option "Select All" to change the current selection.

Print:

Print the browser in Excel format to analyze the data or to check it later.

Make Effective:

Enter the reconciliation type already done to change the status in table, so this record is no longer displayed in future reconciliations.

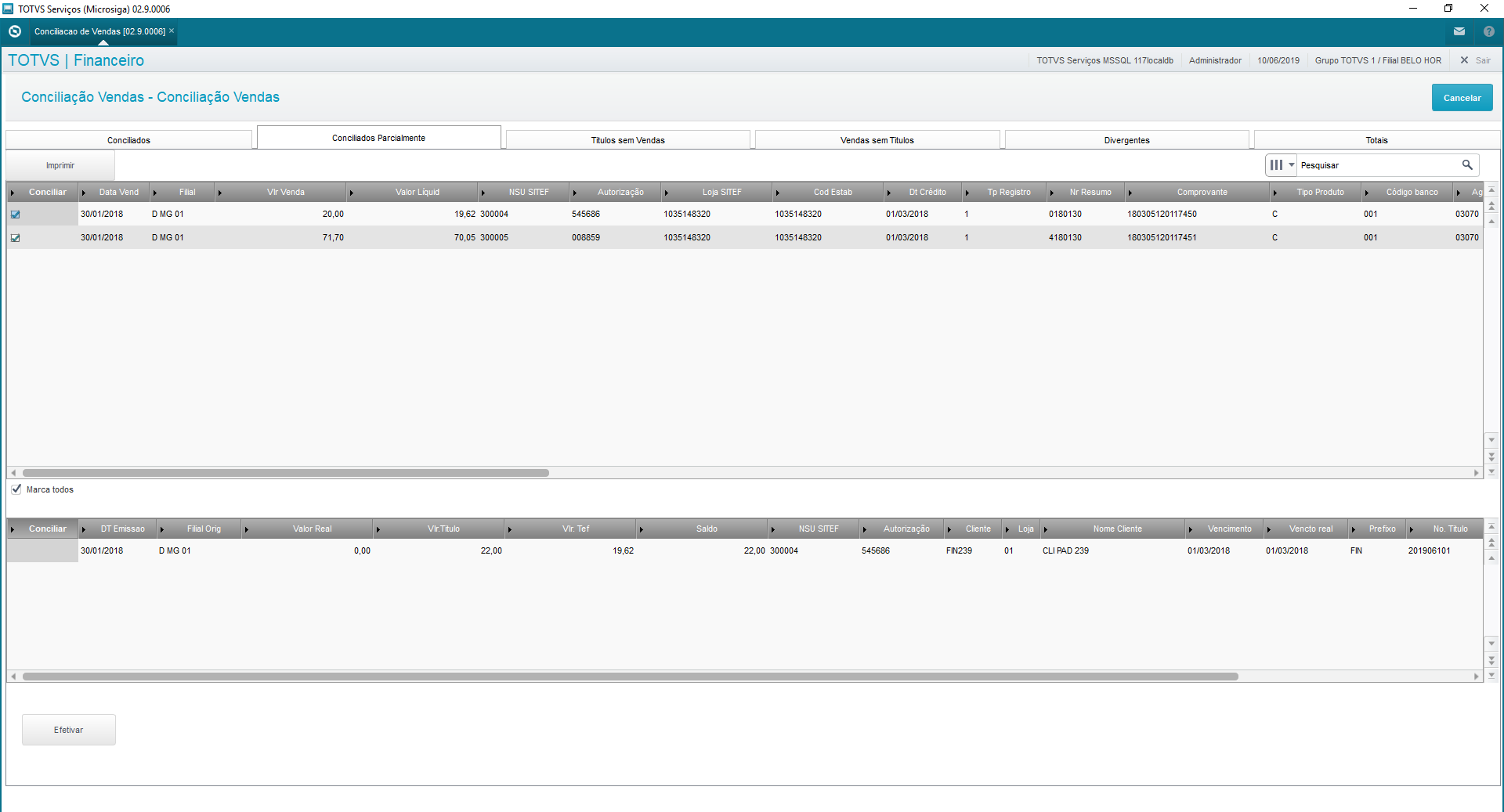

Correspond to imported sales the counterparts of which (financial bills in Protheus) were found in accordance with the relationship key, Branch, Establishment, NSU, installment, issue date, authorization code, type (Debit/Credit) although "outside" the set tolerance percentage.

Tolerance Percentage: Consider that the net sale value must be smaller than the bill balance minus the specified percentage.

Example: Sale

...

Sale (file)

...

Bill (Protheus)

...

Gross Value BRL 200.00

...

Value BRL 225.00

...

Net Value BRL 198.00

...

Balance BRL 225.00

...

Tolerance percentage 10%

Use the following calculation to define whether to fully reconcile it.

Net Value >= Balance - ( Balance * Percentage)

198 < 225 - (225 * 10%)

198 < 225 - 22.5

198 < 202.5

The upper grid shows sales imported through the issuer file, the lower grid shows data from the bill found in the system. The records already appear selected to make the reconciliation effective. You can select item by item or use option "Select All" to change the current selection.

Print:

Print the browser in Excel format to analyze the data or to check it later.

Make Effective:

To correctly control the reconciliation, enter a justification code and a description so you can continue the activation. (you may create the justifications register according to company needs)

Enter type of reconciliation made and save the justification data of said reconciliation, considering it was made outside regular parameters. This update ensures this record is no longer displayed in future reconciliations.

Correspond to all bills found in Protheus not made available in issuer files within the entered sales period (through reconciliation routine parameters) and to corresponding types (Debit/Credit).

The grid shows bills in system that have no sales recorded. You can select item by item or use option "Select All" to change the current selection.

Print:

Print the browser in Excel format to analyze the data or to check it later.

Make Effective:

To correctly control the reconciliation, enter a justification code and a description so you can continue the activation. (you may create the justifications register according to company needs)

Create a record on the sales table based on the data of the bill at issue so future reconciliations no longer show it.

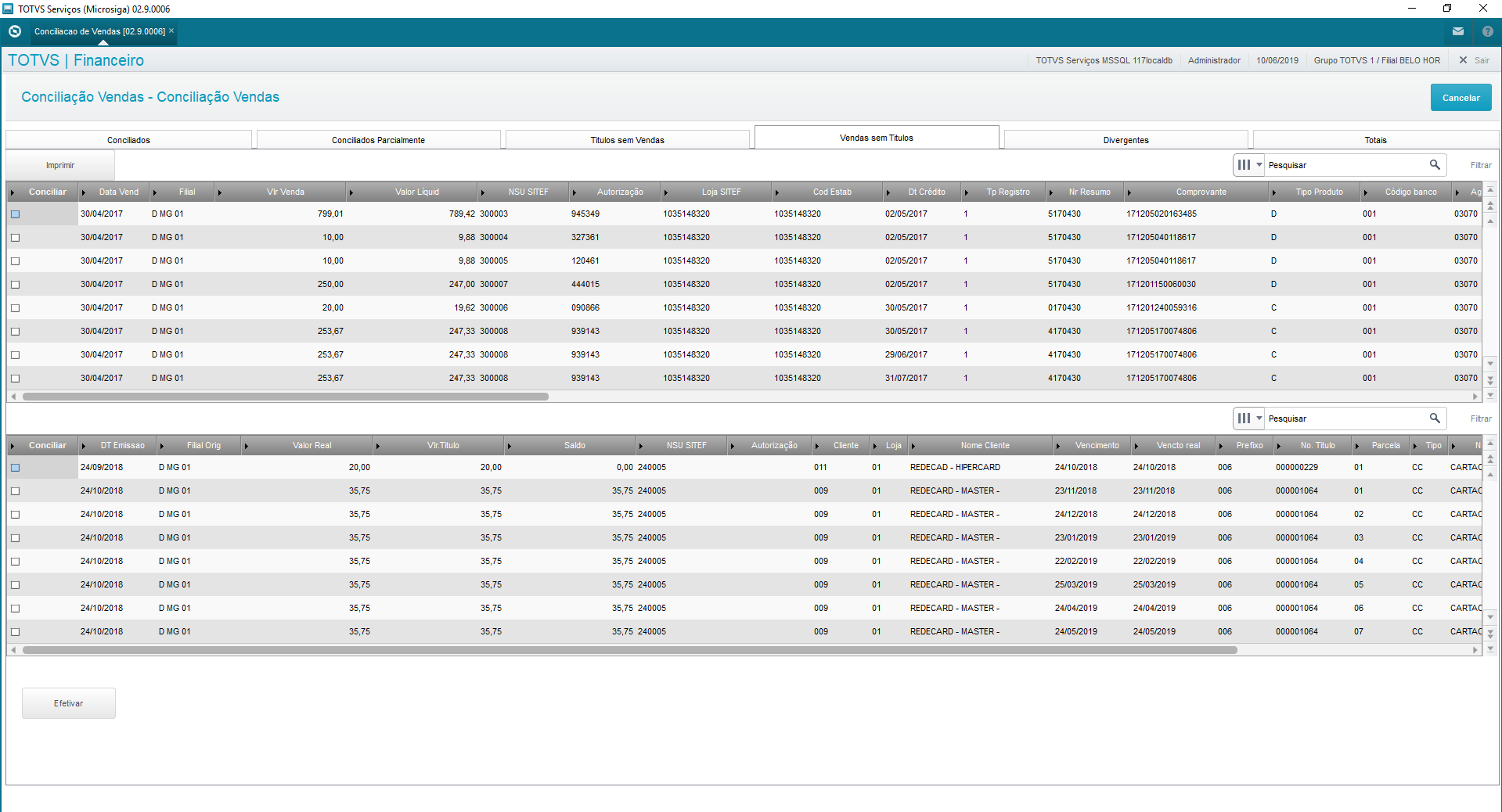

Correspond to sales imported from the issuer file the counterparts of which (financial bills in Protheus) were not found in the Protheus database, enabling manual reconciliation with bills available in the database.

The upper grid shows sales imported through the issuer file that were not reconciled. The lower grid shows all bills in the database fit for reconciliation with sales from LOJA.

Print:

Print the browser in Excel format to analyze the data or to check it later.

Make Effective:

To correctly control the reconciliation, enter a justification code and a description so you can continue the activation. (you may create the justifications register according to company needs)

IMPORTANT: On this screen (Sales Without Bills) some records from imports may not have their respective bills in financials. In this case you may activate the record with a justification. After this activation, the record will have the status: "Record of Sales Without Bills", which you can view in the browser.

Divergences: contains all sales entered in the card company file with some kind of occurrence, such as: Total Refund, Partial Refund, Charge Back, Modality Change.

Print:

Print the browser in Excel format to analyze the data or to check it later.

Save:

To correctly control the reconciliation, enter a justification code and a description so you can continue the activation. (you may create the justifications register according to company needs)

Enter type of reconciliation made and save the justification data of said reconciliation, considering it was made outside regular parameters. This update ensures this record is no longer displayed in future reconciliations.

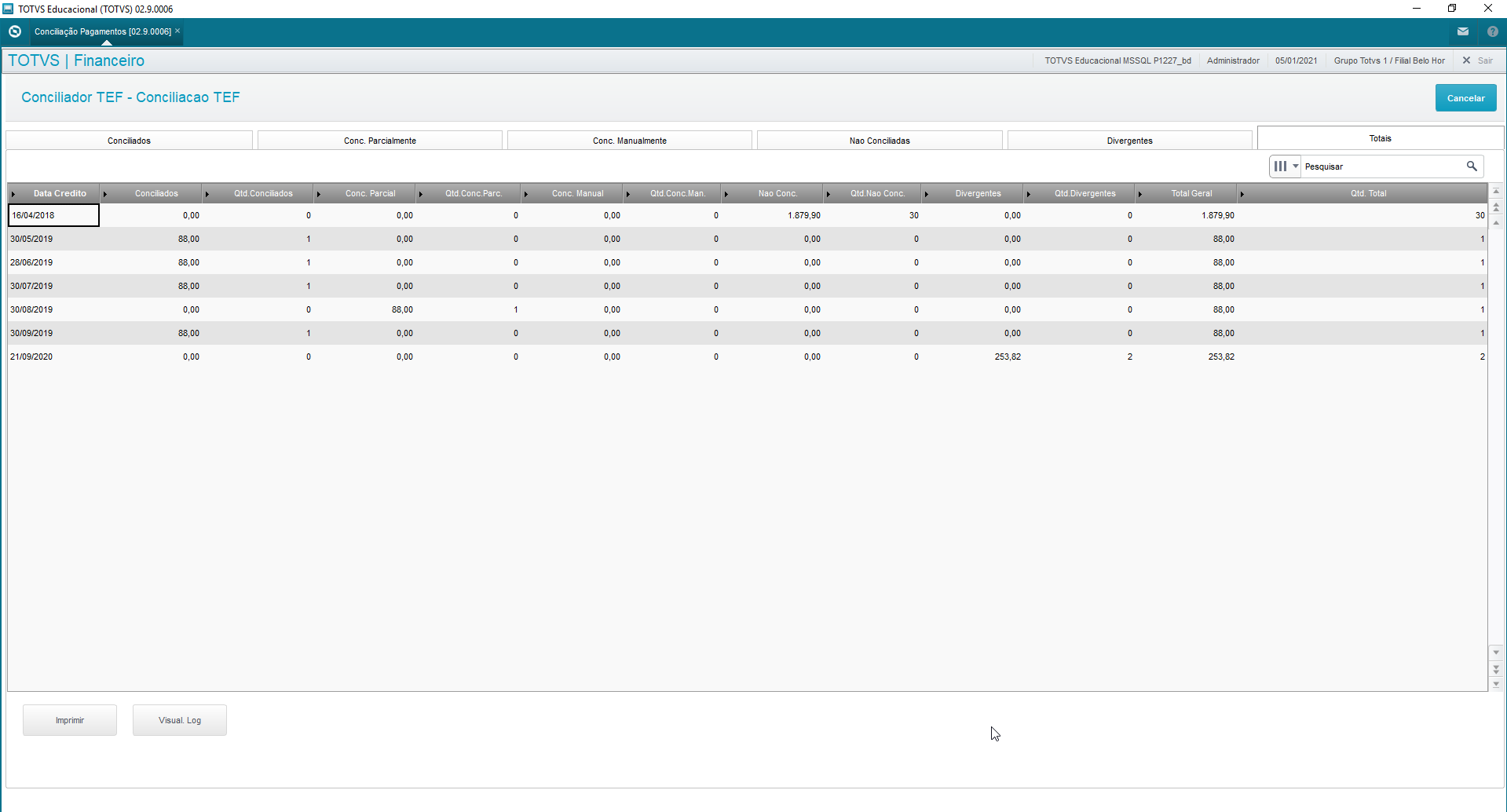

Totals: display quantity of records with gross and net values in BRL by date for each tab.

The process of reconciliation activation only labels the sale as reconciled, no longer showing this sale in future reconciliations.

Unreconcile

| Wiki Markup |

|---|

The process removes the reconciliation data from the sales record, allowing the sale to be reconciled in future processes.

This process can only be executed if the payment reconciliation has not been executed.

Reconciliation Report - FINR916

The reconciliation report shows sales in detail with their corresponding reconciliation "statuses".

Report Parameters:

*Issuer?* Select the issuer.

1 – Soft. Express.2 – Others (Amex, Cielo, Rede).

*Card Brand – Software Express?* Select the Card Brand to filter Software Express data. Use the \[F3\] key to query the Card Brand register.

*Card Company – Others ?* Select the Brand to filter data from other card companies (Amex, Cielo, Rede). Use the \[F3\] key to query the Card Company register.

*Select Branches?* Select option "Yes" to filter branches for the report or "No" to display records from the branch logged.

*From Customer?* Select the initial code of the range of customers to be considered for the report generation. Use the \[F3\] key to query the Customers register.

*From Store?* Select the initial code of the range of customer stores to be considered for the report generation.

*From Customer?* Select the final code of the range of customers to be considered for report generation. Use the \[F3\] key to query the Customers register.

*To Store?* Select the initial code of the range of customer stores to be considered for the report generation.

*From NSU No.?* Select the initial NSU code to generate the report.

*To NSU No.?* Select the final NSU code to generate the report.

*Credit Start Date?* Select the start date of credit generate the report.

*Credit End Date?* Select the end date of credit to generate the report.

*Paymt Reconciliation Status?* Select the payment reconciliation statuses to be considered for report generation. Use the \[F3\] key to query the rules.

*From Paymt Reconciliation Date?* Select the payment reconciliation start date to be considered for report generation. Sales records (FIF) will only contain this date after the payment reconciliation becomes effective.

*To Paymt Reconciliation Date?* Select the payment reconciliation end date to be considered for report generation. Sales records (FIF) will only contain this date after the payment reconciliation becomes effective.

*Sales Reconciliation User?* Select the user who executed the sales reconciliation for report generation. Sales records (FIF) will only contain this date after the sales reconciliation becomes effective. Leave the field blank (empty) if you want all users.

*From Sales Reconciliation Date?* Select the payment reconciliation start date to be considered for report generation. Sales records (FIF) will only contain this date after the sales reconciliation becomes effective.

*To Sales Reconciliation Date?* Select the payment reconciliation end date to be considered for report generation. Sales records (FIF) will only contain this date after the sales reconciliation becomes effective.

*Sales Reconciliation User?* Select the user who executed the sales reconciliation for report generation. Sales records (FIF) will only contain this date after the sales reconciliation becomes effective.

*Print Justification? * Select option "Yes" to print reconciliation justifications in report, if filled out at reconciliation activation. Select "No" to not show the justification.

*Print Reconciliation Data?* Select the sales reconciliation start date to be considered for report generation. Sales records (FIF) will only contain this date after the sales reconciliation becomes effective.

*Printing Order?* Select the printing order to show in the report. Records ordered by:

1 – Recon. / NSU = Reconciliation Order2 – NSU / Recon.= NSU Prder

Import Log - FINA917

*Import Log*

After you finish importing the files through routine Wizard (FINA914), the system allows you to evaluate records disregarded in the import through routine Import Logs "EFT (FINA917)".

The possible statuses of each import are:

* Caption*

* * |

- Successfully Imported - All file lines read, and the sales/payment records successfully created.

- File already imported - An import of a file of same name has already been attempted.

- Incompatible file version - File layout version not approved for import.

- Error when opening file - Unable to read file in configured directory.

- Partially imported - At least one sales/payment record was successfully imported.

- Inconsistent File - Only criticisms regarding SERASA are found in file.

- File Not Imported - No sales/payment record has been imported

On the EFT Imports Log screen you can:

View

Print

Other Actions → Print Browser

Statuses Partially Imported, File Not Imported allow viewing problem details in accordance with the import line.

When the status is "Partially Imported", view the problem detail in the option below:

View

Header:

Status = Occurrence found in file in accordance with the caption.

File name = Name of selected file.

Process Date = Date of processing day.

Process Time = Time of processing.

Added Rec = Quantity of sales/payment records added (FIF).

Does Not Process = Quantity of file lines not processed.

Lines Read = Quantity of files lines read (including lines that formed a sales/payment record).

Fi Li Tot = Total quantity of file lines. Sum of lines not processed with lines read.

User Name = Name of user logged during the import.

Co Name = Name of Card Company/Issuer related to the folder in which the file became available.

Details:

Proc Line = Line of file for analysis of criticism.

Estab Code = Code of establishment - Use it to relate the code at the company with the system branch, set in parameter (*see parameters).

Certificate = Number of sales certificate. However, the record criticized may not have this information. It is only displayed if found in the line evaluated.

Reason = Occurrence found in file.

Some particularities are related to the reasons.

When the criticism is related to not finding the Branch or establishment registered, the system criticizes only one line and totals the other lines with problems, grouping this error in only one line to make viewing easier.

Example: as the image shows, we have 18 lines of the file with the same establishment code, the parameters of which are not set for any branch; thus, all these lines cannot be processed.

The other criticisms are displayed line by line or in a group of lines, depending on the layout of each card issuer.

In View you can also Print the Import Logs Report FINR917 with the details onscreen with no need to select parameters. Just click "Other Actions - Print"

Print

Use it to print the Import Logs Report FINR917, setting parameters and including all import details.

Print Browser

Standard feature to print the current browser.

Import Report - FINR917

Printing via Import Logs routine (menu)

The EFT import log report provides details on the logs generated when importing the "EFT (FINA914)" reconciliation files.

You may call the report via menu, through routine Import Logs (FINR917)

Option Print.

Report Parameters.

From File Name? Enter the name of a given import file to print (Start).

To File Name? You can enter the name of a given import file for printing (End).

From Processing Date? Select the date in which you wish to print the report or period (Start).

To Processing Date? Select the date in which you wish to print the report or period (End).

Card Company? Select the card company.

User of Import? Filter by user who executed the file import.

Top header displays the Import Log table data (FVR)

Co Name: Display card company name.

File Name: Display imported file name.

Bottom header displays the Import Log Details table data (FVR)

Proc Line: File line that generated log.

Estab Code: Code of logged line establishment.

Certificate: Number of certificate.

Reason: Display the reason, in detail, why the file line was not included in the import.

Process Date: Display the date of import file processing.

Pro Time: Display the time of import file processing.

Pr.Rec.Qty: Display the quantity of sales/payment records entered in the system that generate EFT reconciliation files (FIF).

Not Pr.Qty: Display the quantity of lines not processed and registered in table FV3

Pr.Ln.Qty: Display the quantity of lines processed. Example: Header, Trailer, sales details, adjustments, etc.

Lines Qty: Shows the sum of lines processed and not processed, adding up to the total of lines in the file. Sum of Not Pr.Qty and Pr.Ln.Qty.

User Name: Display the name of the user responsible for importing the file.

Status: Display the status of file import.

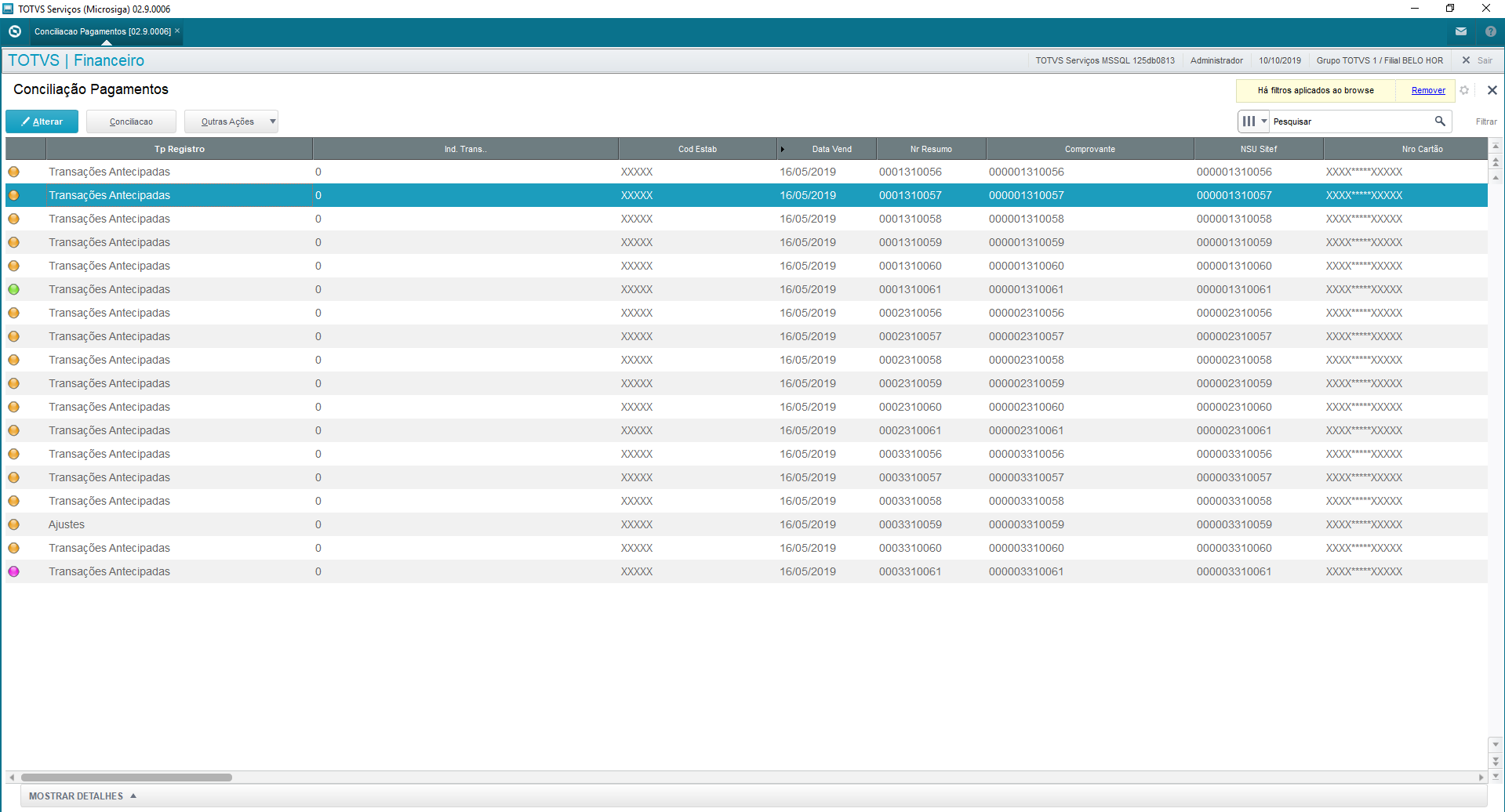

Payment Reconciliation - FINA918

Main browser displays all sales/payment records this routine has imported and enabled. From this browser the reconciliation process begins.

The process reconciles payments, which are records from file imports of the card issuers: CIELO, REDECARD, AMEX and from the Card Company SOFTWARE EXPRESS, with financial records of accounts receivable, which had as payment methods: credit or debit card.

When a payment is reconciled, the bill is posted and its value enters the bank transactions.

Caption:

Captions are updated in accordance with user actions and the comparative results between Protheus and files from the issuers: CIELO, REDECARD, AMEX and from the Credit Card Company SOFTWARE EXPRESS When files are imported, all records start with "Not Processed", changing status as information is processed.

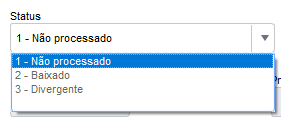

Edit

If needed, you can edit the "status" field of a sales bill. The statuses you can change are:

Posted: This status occurs when payments are reconciled, because this process posts the bills.

Divergent: This status occurs when there are full returns, partial returns, charge back or modality changes.

Not Processed: This status occurs when bills are not reconciled.

It must be emphasized that status adjustments do not reverse bill postings.

Reconciliation

When you select option reconcile, we have this parameters screen: Software Express or Others:

Software Express: reconciliation of sales from the Layout of Software Express.

Others: reconciliation of sales from the Layout Others, which are: Cielo, Rede and Amex.

These options differ in the selection of Card Issuer x Card Company. For Software Express, you can select various card companies, whereas Others offers only the Cielo, Rede and Amex options.

After selection, a screen is displayed with parameters you can fill out:

From Branch? : Initial branch to search sales.

To Branch? : Final branch to search sales.

From Credit Date: Start Date of sale reconciliation. (evaluate the issue date of sale).

To Credit Date: End Date of sale reconciliation. (evaluate the issue date of sale).

From NSU No?: NSU Number (Single Sequential Number) that starts the sale reconciliation. (with zeros to the left).

To NSU No.?: NSU Number (Single Sequential Number) that ends the sale reconciliation. (with zeros to the left).

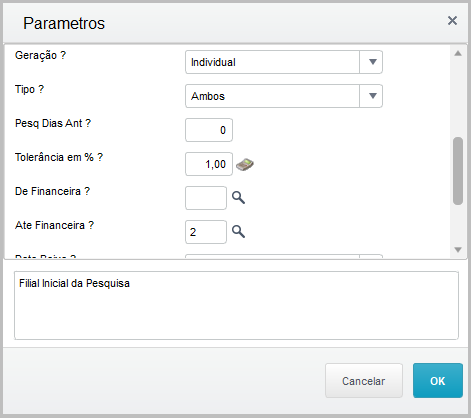

Generation?: Individual - Manually posts bill by bill. By Batch - Automatically posts by batch of bills.

Type?: Select the type to be reconciled. Options: Debit/Credit or Both.

Search Prev Days?: Subtract days from start of selected search. Example: Credit Date 8/20/2018 with this option equal to 2, sales are selected from 8/18/2018.

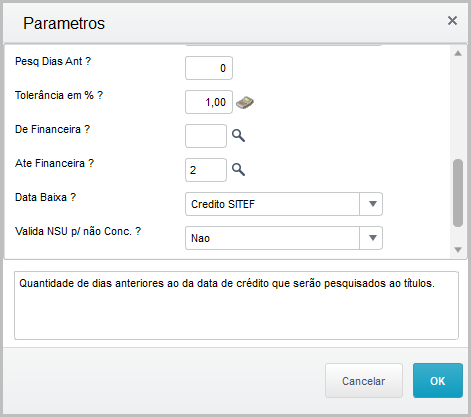

Tolerance in %?: Percentage of the difference in the bill balances between the net sale value of the imported file and the remaining bill balance in the system

From Financial Company?: Code of initial financial company for the filter.

To Financial Company?: Code of final financial company for the filter.

Posting Date?: Set the date of bill posting. Base Date - day of reconciliation execution and SITEF Credit - Credit date sent in file.

Validate NSU f/ Not Rec.?: Validate in tab "Not Reconciled" whether the relationship between a sale and a bill in financials must have the same NSU.

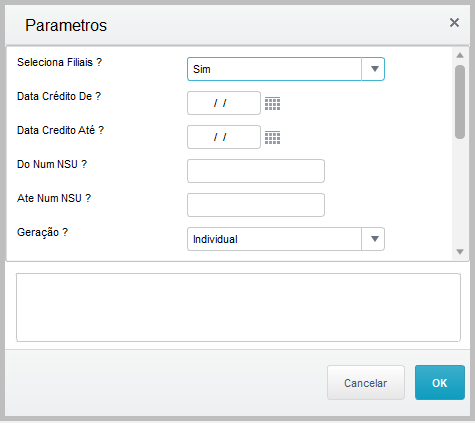

Select Branches: You can select one or more branches. The field is multiple choice for reconciliation of multiple branches.

From Credit Date: Start Date of sale reconciliation. (evaluate the issue date of sale)

To Credit Date: End Date of sale reconciliation. (evaluate the issue date of sale)

From NSU No?: NSU Number (Single Sequential Number) that starts the sale reconciliation. (with zeros to the left)

To NSU No.?: NSU Number (Single Sequential Number) that ends the sale reconciliation. (with zeros to the left)

Generation?: Individual - Manually posts bill by bill. By Batch - Automatically posts by batch of bills.

Type: Select the type to be reconciled. Options: Debit/Credit or Both.

Search Prev Days?: Subtract days from start of selected search. Example: Credit Date 8/20/2018 with this option equal to 2, sales are selected from 8/18/2018.

Tolerance in %: Percentage of the difference in the bill balances between the net sale value of the imported file and the remaining bill balance in the system

Card Company: Click the "magnifying glass" icon to display card companies. You may select one or more card companies to reconcile sales.

Posting Date? : Set the date of bill posting. Base Date - day of reconciliation execution and SITEF Credit - Credit date sent in file.

Validate NSU f/ Not Rec.? : Validate in tab "Not Reconciled" whether the relationship between a sale and a bill in financials must have the same NSU.

Processing Type?: Option created for you to choose the data processing type (by tab → display records of tab selected only) or (General → display records of all tabs)

Tab for Processing?: Tab to be used along with previous parameter. (1-Reconciled / 2-Partially Reconciled / 3-Bills Without Sales / 4-Sales Without Bills / 5-Divergent)

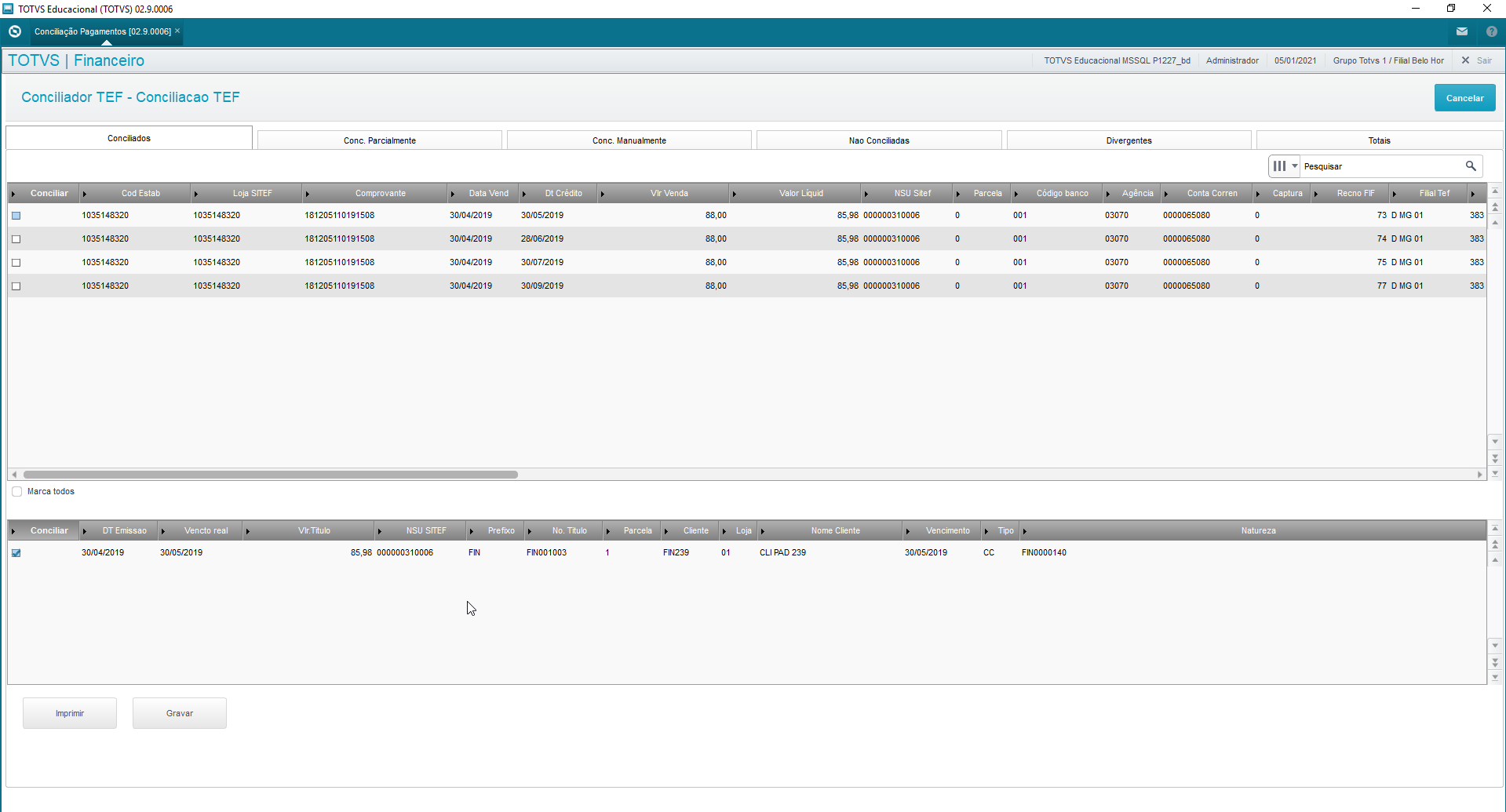

Correspond to imported sales the counterparts of which (financial bills in Protheus) were found in accordance with the relationship key: Branch, Establishment, NSU, installment, issue date, authorization code, type (Debit/Credit) and tolerance percentage (the tolerance percentage is set in routine parameters).

Tolerance Percentage: Consider that the net sale value must be greater than or equal to the bill balance minus the specified percentage.

Example: Sale

...

Sale (file)

...

Bill (Protheus)

...

Gross Value BRL 200.00

...

Value BRL 195.00

...

Net Value BRL 198.00

...

Balance BRL 195.00

...

Tolerance percentage 10%

Use the following calculation to define whether to fully reconcile it.

Net Value >= Balance - ( Balance * Percentage)

198 >= 195 - (195 * 10%)

198 >= 195 - 19.5

198 >= 175.5

The grid above shows sales, imported through the issuer file, already related with bills found in the system. The records already become fit to be reconciled through button "Activate Reconciliation". Reset item selections by clicking item by item.

Print:

To print the upper and lower grids, generated in different tabs, in Excel format for data analysis or to check it later.

Save:

When the reconciliation becomes effective, the bills are posted and, consequently, a bank transaction is made based on the option selected in question Generation (Individual or Batch) and the bank balance is updated with the value posted.

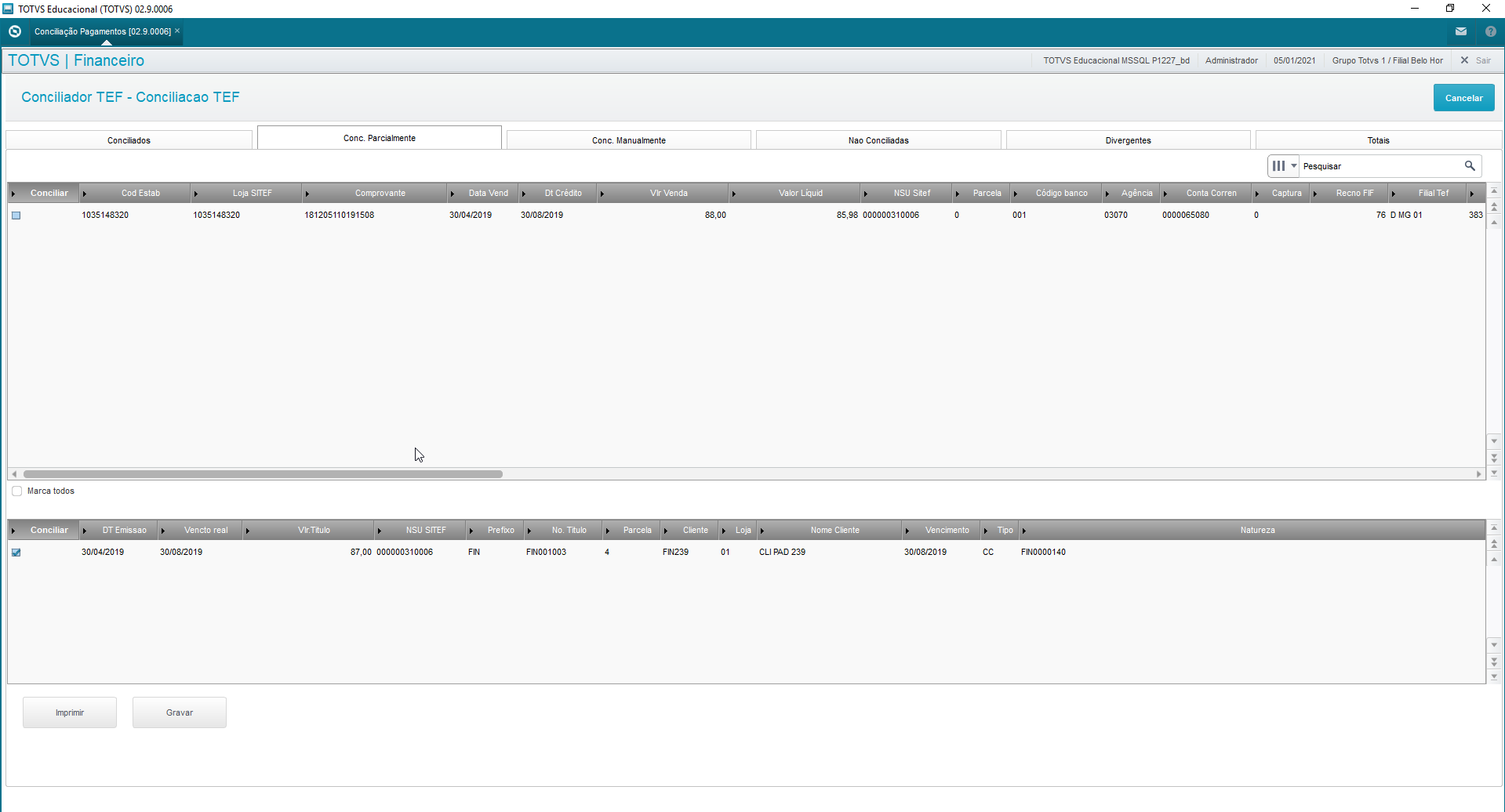

Correspond to imported sales the counterparts of which (financial bills in Protheus) were found in accordance with the relationship key, Branch, Establishment, NSU, installment, issue date, type (Debit/Credit) although "outside" the set tolerance percentage.

Tolerance Percentage: Consider that the net sale value must be smaller than the bill balance minus the specified percentage.

Example: Sale

...

Sale (file)

...

Bill (Protheus)

...

Gross Value BRL 200.00

...

Value BRL 225.00

...

Net Value BRL 198.00

...

Balance BRL 225.00

...

Tolerance percentage 10%

Use the following calculation to define whether to fully reconcile it.

Net Value >= Balance - ( Balance * Percentage)

198 < 225 - (225 * 10%)

198 < 225 - 22.5

198 < 202.5

The upper grid shows sales imported through the file from the card issuer and card companies, whereas the lower grid shows data from the bill found in the system. The records already appear selected to make the reconciliation effective. You can select item by item or use option "Select All" to change the current selection.

Print:

To print the upper and lower grids, generated in different tabs, in Excel format for data analysis or to check it later.

Save:

To correctly control the reconciliation, enter a justification code and a description so you can continue the activation. (you may create the justifications register according to company needs)

When the reconciliation becomes effective, the bills are posted and, consequently, a bank transaction is made based on the option selected in question Generation (Individual or Batch) and the bank balance is updated with the value posted. Save justification data of said reconciliation, considering it was made outside regular parameters.

Tab "Manually Reconciled" displays bills made effective in tab "Not Reconciled", because in tab not reconciled bills are made effective with justifications and, once confirmed, this record is transferred to tab manually reconciled.

The grid displays sales made effective in tab not reconciled with justifications entered by the operator. This tab displays data in execution time onscreen, that is, it always starts empty, being filled as the manual reconciliations occur.

Print:

Print the grid in Excel format to analyze the data or to check it later.

Correspond to sales imported from the issuer files the counterparts of which (financial bills in Protheus) were not found in the Protheus database, enabling manual reconciliation with bills available in the database.

The upper grid shows sales imported through the issuer files that were not reconciled. The lower grid shows all bills in the database fit for reconciliation with sales from SIGALOJA.

If the question at start is Validate NSU f/ Not Rec.?: Is set to YES, the relationship is only allowed if NSU is the same between bill and sale, otherwise the relationship between sale and bill is possible.

Print:

To print the upper and lower grids, generated in different tabs, in Excel format for data analysis or to check it later.

Save:

To correctly control the reconciliation, enter a justification code and a description so you can continue the activation. (you may create the justifications register according to company needs)

When the reconciliation becomes effective, the bills are posted and, consequently, a bank transaction is made based on the option selected in question Generation (Individual or Batch) and the bank balance is updated with the value posted. Save justification data of said reconciliation, considering it was made outside regular parameters.

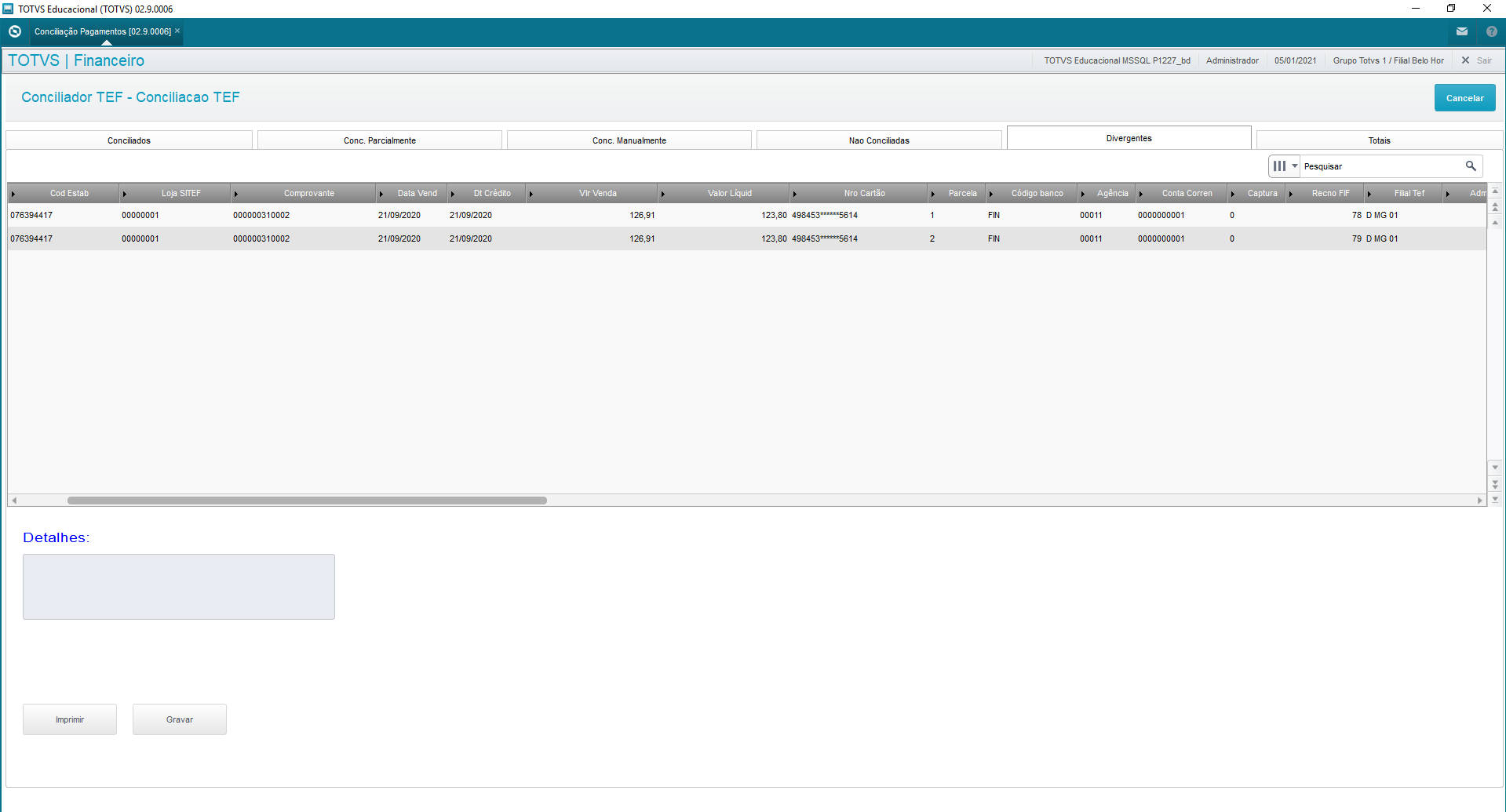

Divergent: contains all sales entered in the card company file with some kind of occurrence, such as: Total Refund, Partial Refund, Charge Back, Modality Change.

Print:

Print the grid in Excel format to analyze the data or to check it later.

Save:

To correctly control the reconciliation, enter a justification code and a description so you can continue the activation. (you may create the justifications register according to company needs)

Enter type of reconciliation made and save the justification data of said reconciliation, considering it was made outside regular parameters. This update ensures this record is no longer displayed in future reconciliations.

Totals: display quantity of records with gross and net values in BRL by date for each tab.

Print:

Print the grid in Excel format to analyze the data or to check it later.

View Log:

Use option "View Log" to evaluate who executed the payment reconciliation routine. Find the name of the user who executed the process in column "User".

04. PARAMETERS

Parameters In Use.

Set the parameters below for the reconciler to operate correctly.

MV_EMPTEF - Establishment code configured for the Software Express card company

MV_EMPTCIE - Establishment code configured for the Cielo card issuer

MV_EMPTAME - Establishment code configured for the AMEX card issuer

MV_EMPTRED - Establishment code configured for the REDE card issuer

All these parameters must be exclusive, representing the Branch to be used in reconciler.

Other parameters used by the routine:

MV_USAMEP - Enter whether the system must use table MEP to reconcile SITEF files (T = uses it; F = does not use it).

MV_1DUP - Define initialization of 1st installment of generated bill. Example: A -> for numeric sequence.

MV_LJGERTX - Generate accounts payable for financial company with rate value, not deducting this rate from accounts receivable.

MV_BXCNAB - Define whether to group bills posted in CNAB return. (S)yes or (N)o.

MV_BLATHD - Quantity of Threads for Payment Reconciliation processing. Maximum of 20.

MV_BLADOC - Define whether to reconcile through field NSU SITEF (FIF_NSUTEF) or Certificate Number (FIF_NUCOMP)

05. ENTRY POINTS

ENTRY POINTS

Entry points used in the payment file import process (Software Express specific)

FINFIF - To add fields when importing the Software Express file - Support Document: {+}http://tdn.totvs.com/x/SX4CE+

FIN910FIL - To edit the contents of file Branch when importing the Software Express file - Support Document: {+}http://tdn.totvs.com/x/s4wDCw+

Entry points used in the payment reconciliation process.

FINA910F - Define bank data when posting bills - Support Document: {+}http://tdn.totvs.com/x/X6Vc+

FA110TOT - To save data complementary to the totalizer record of automatic posting of accounts receivable (FINA110) - Support Document: {+}http://tdn.totvs.com/x/2YQDCw+

06. TABLES

...

Table | Description |

Acronym | FIF |

Name | SITEF Reconciliation File |

Table | Description |

Acronym | FV3 |

Name | EFT Import Log Detail |

Table | Description |

Acronym | FVR |

Name | SITEF Import Logs |

Table | Description |

Acronym | FVX |

Name | Justifications Register |

Table | Description |

Acronym | FVY |

Name | Operator Reasons Register |

Table | Description |

Acronym | FVZ |

Name | Branches to Consider |

Table | Description |

Acronym | MDE |

Name | SITEF Card Company |

Table | Description |

Acronym | MEP |

Name | SITEF Payment in Installments |

For payment reconciliation to work properly, create the fields below.

Field | E1_MSFIL |

Name | Origin branch |

Field | MEP_MSFIL |

Name | Origin branch |

Field | FIF_MSFIL |

Name | Origin branch |

...