Histórico da Página

...

02. RULES AND DEFINITIONS

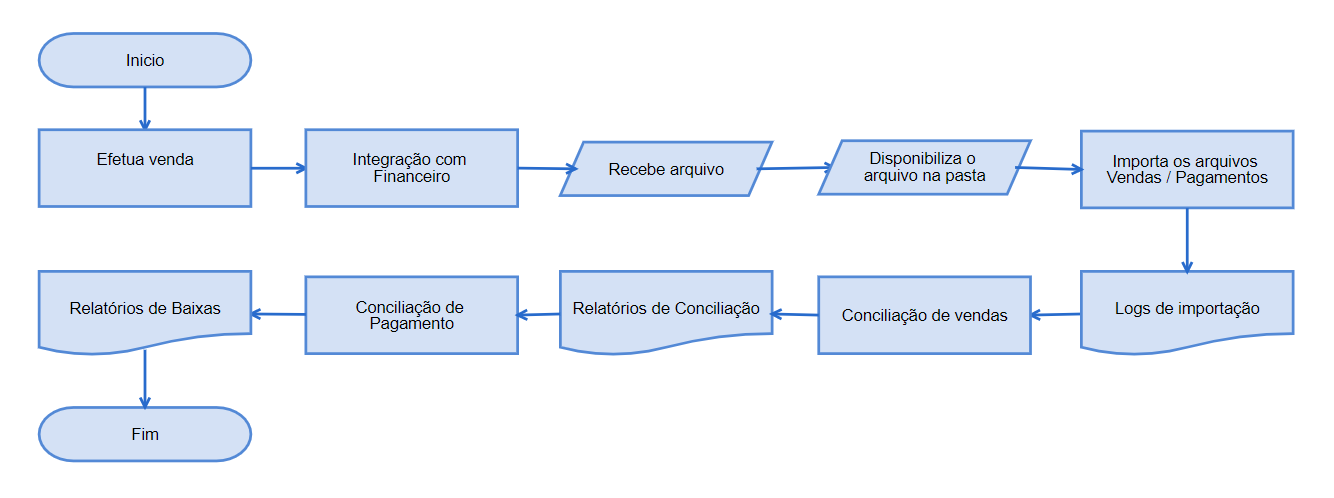

Operational Flow

Description of processes

- Make sale: Through the source module, the system records the sales transactions, allowing even the use of multiple cards for the payment.

- Integration with Financials: Generation of bills receivable of respective sales, with specific transaction information: NSU Code - Exclusive Sequential Number of the operation and Authorization Code of sales operation.

- Receive file: Receipt of files generated by card companies.

- Make file available in folder: Saving of files in specific directories:

\baseline\cartao\Import – Directory in which the files are saved for reading/processing.

\baseline\cartao\Process – Directory in which the successfully processed files are automatically saved.

\baseline\cartao\falha – Directory in which files with errors are automatically saved.

To run this process in the SIGALOJA module, register the card companies that must have the "RD - Network" data.

- Import Payments/Sales file: Saving successfully processed records. This process only embraces ratified layouts: Software Express, Cielo, Rede and Amex. Occasional import criticisms will be available through a log, for future analysis and to take measures.

- Import log: View import criticisms detailing each occurrence, with option to print.

- Sales Reconciliation: Reconcile sales records (imported from files) with financial records of accounts receivable. For reconciliation, configure routine questions. From the configuration of these questions, records are displayed in tabs onscreen to be reconciled, as explained below:

...

- Reconciled: Correspond to imported sales the counterparts of which (financial bills) were found in accordance with the relationship key: Branch, Site, NSU, Installment, Issue Date, Authorization Code, type "CD" (Automatic Debit Card) or "CC" (Automatic Credit Card) and whether the difference between the value of the sale imported and the value of the financial bill balance is within the tolerance percentage set in routine processing questions.

- Partially Reconciled: Correspond to imported sales the counterparts of which (financial bills) were found in accordance with the relationship key: Branch, Site, NSU, Installment, Issue Date, Authorization Code, type "CD" (Automatic Debit Card) or "CC" (Automatic Credit Card) and whether the difference between the value of the sale imported and the value of the financial bill balance is outside the tolerance percentage set in routine processing questions.

- Bills Without Sales: Correspond to all bills in the database in the period entered in routine processing questions not found in card issuer files.

- Sales Without Bills: Correspond to sales imported from the card issuer and/or card company file the counterparts of which were not found as financial bills, enabling the manual reconciliation of bills available in the database.

- Divergences: Correspond to information available in card issuer or card company files, for manual action of the system user. For example: Total Refund, Partial Refund, Charge Back, Modality Change.

- Totals: Display quantity of records and values processed by date for each of the respective tabs.

- Reconciliation Report: For the evaluation of sales reconciliations.

- Payment Reconciliation: Reconcile payment records (imported from files) with financial records. For reconciliation, configure routine questions. From the configuration of these questions, records are displayed in tabs onscreen to be reconciled, as explained below:

- Reconciled: Correspond to imported payments the counterparts of which (financial bills) were found in accordance with the relationship key: Branch, Site, NSU, Installment, Issue Date, type "CD" (Automatic Debit Card) or "CC" (Automatic Credit Card) and whether the difference between the value of the sale imported and the value of the financial bill balance is within the tolerance percentage set in routine processing questions.

...

- Partially Reconciled: Correspond to imported payments the counterparts of which (financial bills) were found in accordance with the relationship key: Branch, Site, NSU, Installment, Issue Date, Type "CD" (Automatic Debit Card) or "CC" (Automatic Credit Card) and whether the difference between the value of the sale imported and the value of the financial bill balance is outside the tolerance percentage set in routine processing questions.

- Manually Reconciled: Correspond to payments the user has manually reconciled while running this routine.

- Not Reconciled: Correspond to imported payments the counterparts of which (financial bills in Protheus) were not found, enabling manual reconciliation with bills available in the database.

- Divergences: Correspond to information available in card issuer or card company files, for manual action of the system user. For example: Total Refund, Partial Refund, Charge Back, Modality Change.

- Totals: display quantity of records and values processed by date for each of the respective tabs.

- Postings Report: You may use default system reports to evaluate postings made by the reconciliation process, such as:

...

- Postings Report

...

- Bank Statement

Utilization Rules and good practices.

...

- FIF->FIF_NSUTEF

- SE1→E1_NSUTEF

- SL1->L1_NSUTEF

- SL4->L4_NSUTEF

- MDK->MDK_NSUTEF

Layouts

We currently have the following layouts approved for importing:

...